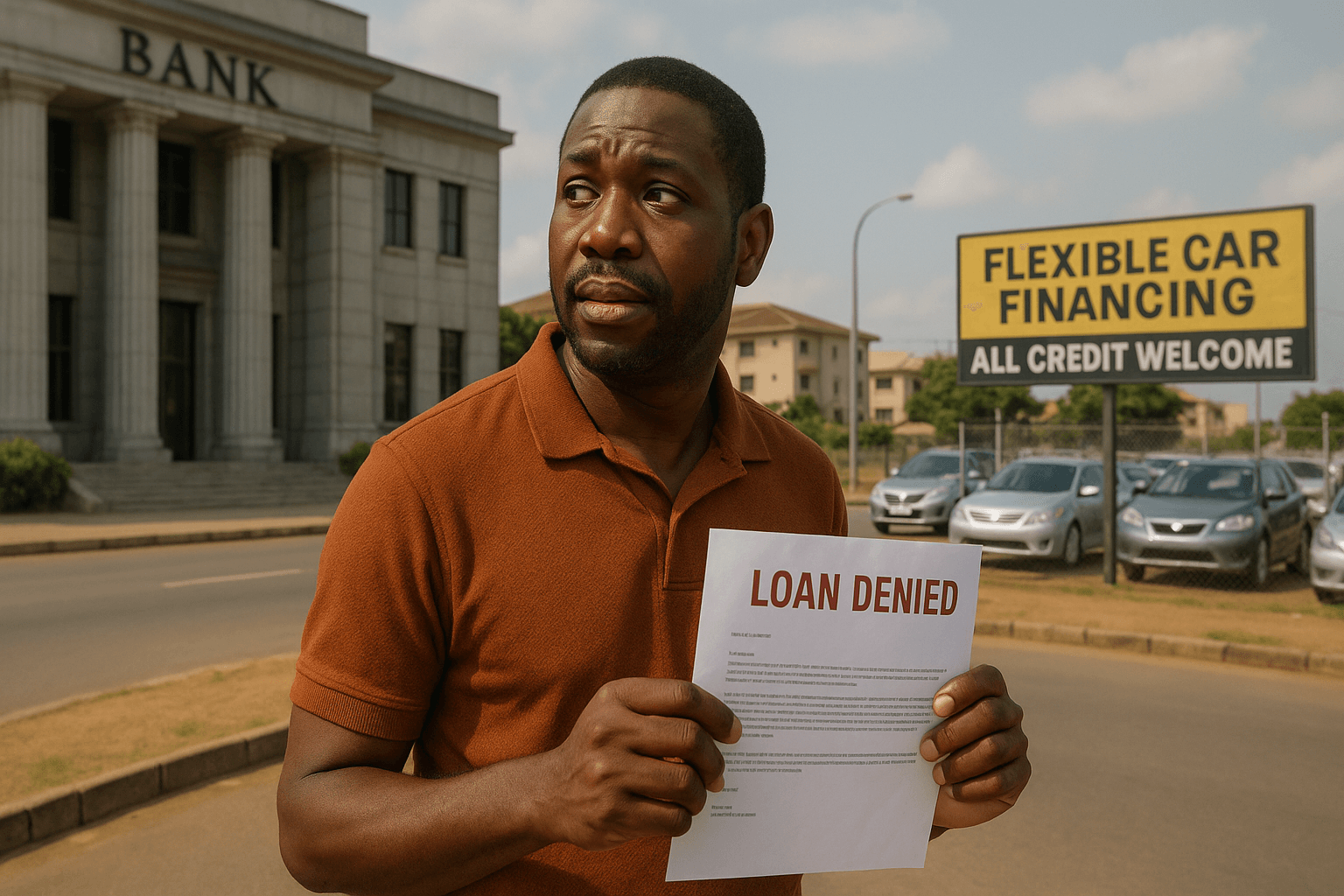

So, you’ve been dreaming of a car—a reliable Tokunbo vehicle to ease your commute or support your business in Abuja—but your credit history is making traditional banks shut their doors?

It’s a deeply frustrating position many hardworking Nigerians find themselves in, often through no fault of their own, perhaps due to past financial setbacks or simply not having a formal credit footprint. This rejection doesn’t have to be the end of your car ownership journey.

The very search for terms like buy here pay here abuja and guaranteed car finance nigeria indicates that a significant number of individuals are seeking solutions outside conventional banking channels. This situation, where individuals feel they have limited choices, can unfortunately make them more susceptible to less favorable, or even predatory, lending terms.

This article is your honest, expert guide to navigating the often-murky waters of alternative car financing in Abuja. We will explain exactly what “Buy Here Pay Here” means, debunk the myths of “no credit check” deals, and provide you with the knowledge to protect yourself and make the best possible decision for your financial future.

This guide focuses on special financing. For an overview of standard loans, first read our Understanding Car Loans, and for a full overview of all your financing options, read our The Complete Guide to Financing a Tokunbo Car in Nigeria.

What is “Buy Here, Pay Here” (BHPH)?

“Buy Here, Pay Here” is a type of in-house financing offered directly by a car dealership. In a traditional car loan, the dealer is a middleman who connects you with a separate financial institution, like a bank.

With a BHPH arrangement, the dealership itself is the lender. You buy the car from them, and you make your weekly or monthly payments directly back to them.

This model is specifically designed for buyers with low or non-existent credit scores who are unable to secure financing from traditional banks.

The dealership assumes a higher risk by lending to this group, and this risk is reflected in the terms of the deal.

The Truth Behind “No Credit Check” and “Zero Deposit” Cars

You will often see adverts promising “Guaranteed Approval,” “No Credit Check,” or “Zero Deposit.” It’s crucial to understand what these phrases really mean in the Nigerian context.

- “No Credit Check” Reality: While BHPH dealers are far more lenient than banks, they still need to ensure you can make your payments. Instead of a formal credit bureau check, they will perform their own assessment, often based on the stability of your job, your income, and where you live. They are less concerned with your past financial mistakes and more concerned with your current ability to pay them back.

- The “Zero Deposit” Catch: True zero-deposit deals are extremely rare and should be viewed with skepticism. The cost of the down payment is not forgiven; it is almost always factored back into the loan in other ways. This could mean a significantly higher vehicle price, an extremely high interest rate, or the inclusion of various administrative fees that inflate the total cost.

The primary trade-off with these alternative financing options is clear: you gain easier access to a loan, but you pay a significant premium for it.

Is a BHPH Deal Right for You? A Hard Look at the Pros and Cons

Before considering a Buy Here Pay Here dealership, you must weigh the convenience against the considerable risks.

| Aspect | The Pros (The Appeal) | The Cons (The Risk) |

| Loan Approval | Much Easier Qualification: The primary benefit is that they cater specifically to buyers with bad or no credit history whom banks have rejected. | Extremely High Interest Rates: To compensate for the high risk, interest rates are often substantially higher than any bank loan, sometimes exceeding 30-40% APR. |

| Vehicle Selection | One-Stop Shopping: The entire process—choosing a car and getting financed—happens at one location. | Limited & Lower-Quality Inventory: BHPH lots typically stock older, higher-mileage vehicles that they own outright. You will not find the latest Tokunbo models here. |

| Repayment Terms | Flexible Payment Schedules: Many offer weekly or bi-weekly payment plans that can align with how you get paid. | Inflexible and Strict Policies: Missing even a single payment can lead to aggressive collection tactics and rapid repossession of the vehicle. |

| Building Credit | It provides a vehicle when no other option exists. | May Not Improve Your Credit Score: Many in-house financing deals are not reported to credit bureaus, meaning your timely payments may not help rebuild your official credit history. |

| Overall Cost | Provides immediate access to a car. | You Will Pay Significantly More: Due to the high interest rate and potentially inflated vehicle price, the total amount you pay for the car over the life of the loan will be much higher than its actual market value. |

Protecting Yourself: Your Checklist Before Signing a BHPH Deal

If you decide that a BHPH loan is your only option, you must proceed with extreme caution. This is a market where the buyer must be incredibly diligent to avoid predatory practices.

- Get EVERYTHING in Writing: Never agree to a verbal deal. Demand a formal contract that clearly lists the vehicle price, the interest rate (APR), the total loan amount, the exact monthly/weekly payment, the loan tenure, and the total amount you will have paid by the end.

- Understand the Total Cost: Ignore the appealing low weekly payment. Ask for the total cost of the vehicle including all interest. You may be shocked to find you’ll be paying two or three times the car’s actual worth.

- The Car MUST Be Independently Inspected: This is absolutely non-negotiable. The quality of cars at BHPH lots can be lower. You must pay for your own trusted mechanic to perform a thorough pre-purchase inspection to uncover any hidden mechanical issues.

- Know the Late Payment & Repossession Terms: Read the fine print carefully. Understand exactly what happens if you are a day late on a payment. Some contracts include tracking devices and remote engine immobilizers that the dealer can activate immediately upon a missed payment.

A professional inspection is even more critical with these cars. Use our Tokunbo Car Inspection Checklist.

Key Takeaways

- “Buy Here, Pay Here” (BHPH) Means the Dealer is the Lender. This type of financing is offered directly by the car dealership and is designed for buyers who may not qualify for traditional bank loans, but it operates under a different set of rules and risks.

- Expect to Pay a Significant Premium. The primary trade-off for easier approval is a much higher interest rate. The total amount you pay for the car over the life of the loan will be considerably higher than its actual market value. This is the cost of borrowing with a challenging credit history.

- Be Wary of “Zero Deposit” Promises. Offers of car finance with no down payment often hide the cost elsewhere, typically through an even higher interest rate or an inflated vehicle price. These deals require extreme scrutiny of the total cost.

- Vehicle Quality is a Major Concern. The inventory at BHPH lots often consists of older, higher-mileage vehicles. A thorough, independent mechanical inspection is absolutely essential to avoid purchasing a car with significant hidden problems.

- Get Everything in Writing and Read the Fine Print. Before committing, you must have a clear contract detailing the car’s price, the exact interest rate (APR), the total loan amount, and the strict terms for late payments and vehicle repossession.

Conclusion: A Stepping Stone, Not a Final Destination

For some individuals, a Buy Here Pay Here loan can be a necessary stepping stone to car ownership when all other doors are closed. It can provide essential transportation needed to get to a better job and begin rebuilding financially. However, it should never be seen as a long-term solution. The high costs and risks mean that the goal should be to use this opportunity to establish a payment history and work towards improving your financial standing so you can eventually qualify for a more affordable, traditional loan.

At Autokunbo.com, we believe in transparent and fair financing for everyone. While we work primarily with traditional lending partners, our team can offer free, honest advice on how to strengthen your loan application. Contact our finance advisors today to discuss all your options for getting behind the wheel.