You’ve finally done it. After weeks of searching, inspecting, and negotiating, you’ve purchased your Tokunbo car. The feeling is exhilarating. But before you hit the Abuja Expressway to celebrate, there’s one more crucial, non-negotiable step: getting the right car insurance.

In Nigeria, motor insurance isn’t just a good idea—it’s the law. Driving without at least a basic policy can lead to fines, vehicle impoundment, and significant legal trouble.

More importantly, the right insurance policy is the single most important shield protecting your valuable new asset from the unpredictable risks of our roads, from minor fender benders in a “go-slow” to the unfortunate possibility of theft.

But the world of insurance can be confusing, filled with terms like “third-party,” “comprehensive,” and “premium.”

This guide will demystify it all. We will break down exactly what each policy type covers, how much you should expect to pay, and how to choose a reliable insurance company that will actually be there for you when you need them most. This is your complete guide to buying car insurance in Nigeria with confidence.

This guide is a key part of the post-purchase process. For a complete overview of buying a car, read our The Ultimate Guide to Buying Tokunbo Cars in Abuja.

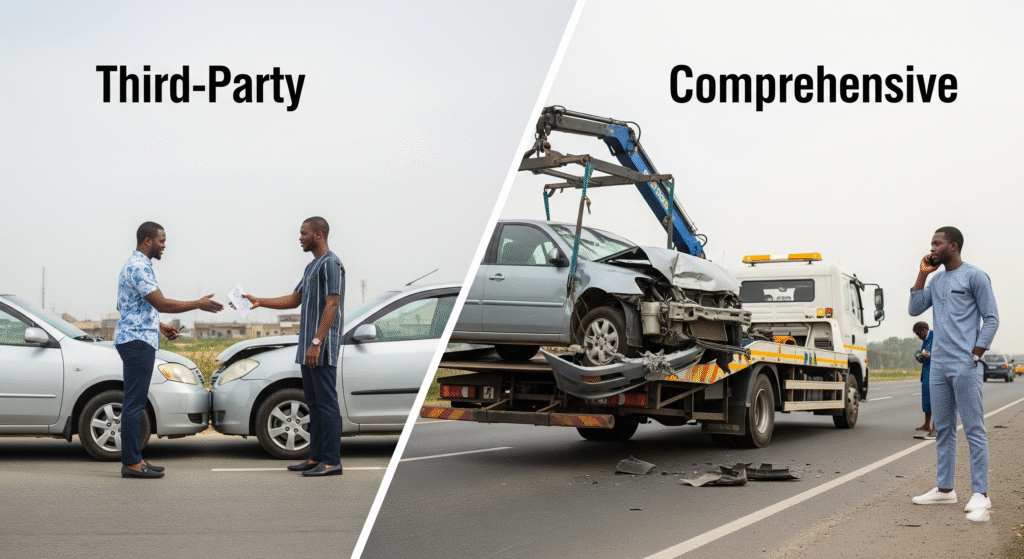

Third-Party vs. Comprehensive: Decoding Your Motor Insurance Options

In Nigeria, there are primarily three types of motor insurance policies. While only one is legally required, understanding the coverage of all three is essential to protecting yourself properly.

Comparison of Nigerian Car Insurance Policies

| Feature | Third-Party Only | Third-Party, Fire & Theft | Comprehensive |

| What It Covers | Damage to third-party property (e.g., their car, fence), injury or death to third parties caused by your vehicle. Does not cover your own car. | All Third-Party Only covers, PLUS loss or damage to your own vehicle due to fire or theft. | All Third-Party, Fire & Theft covers, PLUS accidental damage to your OWN car (collision, vandalism), and often includes flood, natural disasters, medical expenses, SRCC. |

| Legal Requirement | Mandatory minimum insurance cover required by Nigerian law. | Exceeds the legal minimum. | Exceeds the legal minimum. Highly recommended for valuable cars. |

| Best For | Meeting the absolute legal minimum requirement; owners of very old, low-value cars; tightest budgets. | Owners wanting more than basic cover, concerned about fire/theft for their own car but not necessarily full accidental damage cover for it. | All Tokunbo, new, and high-value vehicles. This is the only policy that truly protects your financial investment in your car; may be required for financed/leased vehicles. |

| Estimated Annual Cost | Fixed by law at ₦15,000 for private vehicles (Fixed premium). | Varies; typically based on the car’s value. Generally more than Third-Party Only and less than Comprehensive. | Varies; calculated as a percentage of your car’s agreed value (typically 3% to 7%) |

Why Third-Party Isn’t Enough for Your Tokunbo Car

While Third-Party insurance fulfills your legal obligation, it offers you, the car owner, almost zero protection. If you are in an accident that is your fault, your insurance will pay to fix the other person’s car, but you will be left to cover the entire cost of repairing your own vehicle out-of-pocket.

For a valuable asset like a Tokunbo car, where a single accident could result in repairs costing hundreds of thousands or even millions of Naira, this is an unacceptable financial risk.

Comprehensive insurance is the only policy that provides true peace of mind. It is designed to protect your actual investment. Our findings confirm that a good comprehensive policy in Nigeria typically covers:

- Accidental Damage to Your Own Car: Whether it’s a major collision or a minor parking lot ding, this policy covers the repair costs.

- Theft: If your vehicle is stolen, the insurance company will pay you its insured value. Given the risk of car theft, this coverage is essential.

- Fire Damage: Protects your investment from loss due to accidental fire.

- Flood Damage: In a city like Lagos or other flood-prone areas, this coverage can be a lifesaver, covering damage from natural disasters.

- Medical Expenses: Often covers a certain amount of medical expenses for you and your passengers following an accident.

- Third-Party Liability: It includes the mandatory coverage for damage to other people’s property and bodily injury.

Before buying, make sure you know how to protect your car. Read our guide on Car Security and Anti-Theft Solutions.

The Price of Car Insurance: A Breakdown

The cost of car insurance in Nigeria is determined by the type of policy and the value of your vehicle.

- Third-Party Insurance: The price for private vehicles is fixed by law at ₦15,000 per year. Be wary of anyone offering it for less, as it is likely a fraudulent policy.

- Comprehensive Insurance: The cost, known as the “premium,” is calculated as a percentage of the total value of your car (this is called the “sum insured”). According to findings, this rate typically ranges from 3% to 7%. The exact percentage depends on the insurance company, your age, the age of the car, and your driving history.

Estimated Annual Comprehensive Insurance Premiums

| Insured Value of Your Tokunbo Car | Estimated Annual Premium (at 3.5%) |

| ₦8,000,000 | ₦280,000 |

| ₦12,000,000 | ₦420,000 |

| ₦20,000,000 | ₦700,000 |

As you can see, while more expensive, the premium is a small fraction of your car’s value, protecting you from a total financial loss.

Choosing the Best Insurance Company

Not all insurance companies are created equal. The most important factor when choosing a provider is not the cheapness of the premium, but their reputation for paying claims quickly and fairly.

A cheap policy from an unreliable company is worthless when you actually need it.

Based on market reputation and reliability data from our research, here are some of the top-rated car insurance companies in Nigeria:

- Leadway Assurance: One of the largest and most reputable insurers in Nigeria, known for a strong financial standing and a reliable claims process.

- AIICO Insurance: A long-standing company with a wide range of products and a solid reputation for customer service.

- AXA Mansard Insurance: A member of a global insurance group, they are known for their professionalism and efficient claims handling.

- Allianz Nigeria Insurance: Another global powerhouse with a strong presence in Nigeria, offering robust and reliable motor insurance products.

- Cornerstone Insurance PLC: A well-regarded local insurer known for its innovative products and customer-centric approach.

When making your choice, it is advisable to get quotes from at least two or three of these top-tier companies.

Key Takeaways

- Third-Party Insurance is the Legal Minimum, Not Full Protection. While you are legally required to have at least Third-Party insurance in Nigeria, this policy only covers damages to other people’s property. It will not pay for any repairs to your own car.

- Comprehensive Insurance is Essential for Any Tokunbo Car. To protect your actual financial investment, a Comprehensive policy is a must. It is the only type of insurance that covers the cost of repairs to your own vehicle after an accident, as well as covering risks like theft and fire.

- Budget 2.5% to 5% of Your Car’s Value for Comprehensive Coverage. The annual premium for comprehensive insurance is calculated as a percentage of your car’s agreed value. For a vehicle valued at ₦10,000,000, you should realistically budget between ₦250,000 and ₦500,000 per year for your premium.

- Choose Your Insurer Based on Reputation for Paying Claims. The cheapest insurance policy is useless if the company fails to pay out when you have a claim. It is critical to choose reputable, well-established companies known for their efficient and fair claims process, such as Leadway Assurance, AIICO, or AXA Mansard.

- Always Verify Your Policy. After purchasing a policy, use the Nigerian Insurance Industry Database (NIID) portal to verify that your policy is genuine and has been logged correctly. This simple check protects you from fraudulent policies.

Conclusion: Insurance is an Investment, Not an Expense

It’s easy to view insurance as just another mandatory fee. However, you should see it as a crucial investment in your financial security.

A comprehensive insurance policy is the protective shield around your vehicle, ensuring that one unfortunate incident on the road doesn’t turn your dream car into a financial disaster. Always opt for a comprehensive plan from a reputable company.

Protecting your new car is a critical step in the ownership journey. At Autokunbo.com, we partner with Nigeria’s leading insurance providers to help you get comprehensive coverage quickly and easily. Ask our team about insurance options when you purchase your next vehicle.