You need to sell your car, but you’re still making monthly payments on it. It’s a common situation that can make sellers feel “stuck” or trapped, believing it’s impossible or illegal to sell a vehicle that isn’t fully paid off.

Let’s be clear: this is a myth. Selling a car with an outstanding loan in Nigeria is entirely possible and legal, but it requires following a specific, secure, and transparent process.

Failing to follow the correct procedure can lead to serious legal and financial complications for both you and the buyer. This guide is your definitive roadmap.

We will walk you through the entire process step-by-step, from understanding your exact financial position to safely managing the transaction with either a private buyer or a dealership.

By the end, you will have the confidence and knowledge to sell your financed car legally and securely.

This is a special selling situation. For the general process of selling a car, first read our The Ultimate Guide to Selling Your Car in Nigeria.

Before You Do Anything: You Must Know These Two Numbers

The entire process of selling a financed car hinges on two critical financial figures. You cannot proceed without knowing these numbers precisely.

Step 1: Get Your “Loan Settlement Figure” from Your Lender

The first and most important step is to contact the bank or finance company that holds your loan and request an official Loan Settlement Figure.

This is not the same as the remaining balance you see on your app; it is the exact, up-to-the-day amount required to completely close the loan.

This figure includes the remaining principal balance plus any accrued interest and early termination fees. This document is non-negotiable, as it forms the financial basis for the entire transaction.

Step 2: Determine Your Car’s Current Market Value

Once you know exactly how much you owe, you need to determine how much your car is actually worth in today’s market.

This requires a thorough Comparative Market Analysis (CMA) by checking online platforms for similar vehicles. This step is crucial for understanding your financial position in the sale.

For a detailed guide on this, read our How to Price Your Used Car.

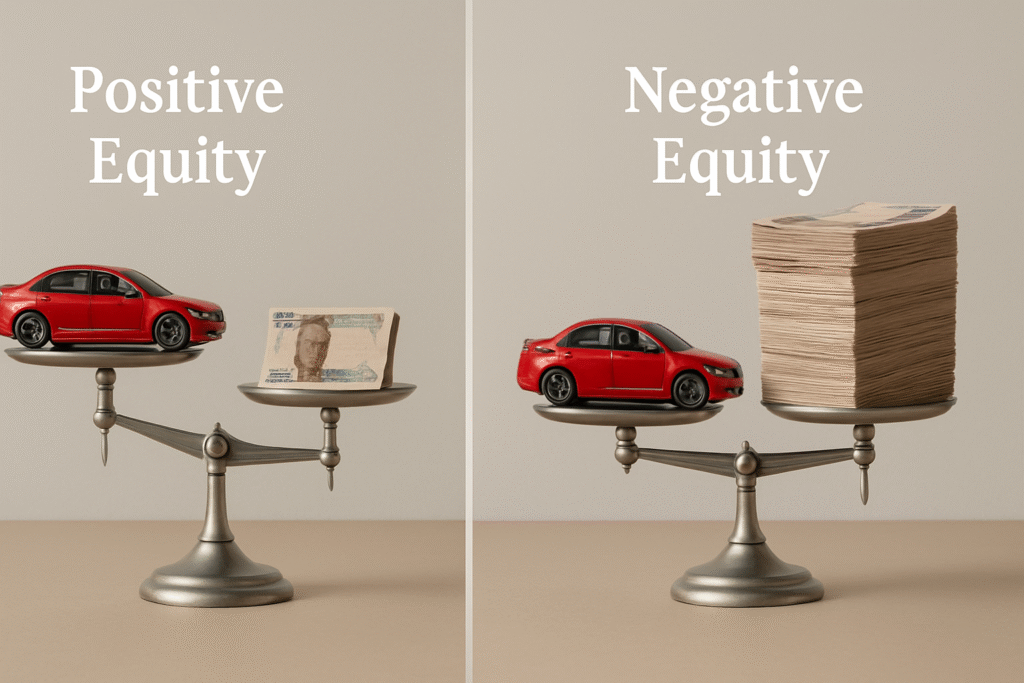

Equity vs. Negative Equity: Are You “Upside Down” on Your Loan?

Once you have your Loan Settlement Figure and your car’s Market Value, you can determine your equity position. This will dictate how the sale will proceed financially.

- Positive Equity (The Ideal Scenario): This occurs when your car’s market value is more than your loan settlement figure.

- Example: Your car’s market value is ₦5,000,000.

- Your loan settlement figure is ₦4,000,000.

- Your positive equity is ₦1,000,000. This is the amount of cash you will receive after the loan is paid off.

- Negative Equity / “Upside Down” (The Challenging Scenario): This occurs when your car’s market value is less than your loan settlement figure.

- Example: Your car’s market value is ₦4,000,000.

- Your loan settlement figure is ₦5,000,000.

- Your negative equity is ₦1,000,000. This means that to sell the car, you must be prepared to pay ₦1,000,000 of your own money to the lender at the time of sale to clear the loan.

The Process: Selling a Financed Car to a Private Buyer

Selling a financed car to a private individual is more complex and carries more risk than a standard sale, but it can be done safely if you follow a strict protocol.

- Be Completely Transparent: You must inform any potential buyer from the very beginning that the vehicle has an outstanding loan. Explain that the final transaction will need to take place at your lender’s bank branch to ensure a secure process for both parties. Hiding this fact will destroy trust and kill the deal later on.

- The Secure Transaction Venue: The only safe place to complete the sale is inside your lender’s banking hall. Do not agree to meet anywhere else. This allows the bank officials to act as a neutral third party, verifying the payment and the loan closure simultaneously.

- The Payment Process: This must be handled with precision.

- The buyer must transfer the Loan Settlement Figure directly into the bank’s account designated for loan payoffs.

- The buyer then pays any remaining balance (your equity) directly into your personal account.

- If you have negative equity, you must pay the shortfall to the bank at this same time.

- The Document Release: Once the bank confirms they have received the full settlement amount, they will issue two critical documents: a formal Letter of Non-Indebtedness (confirming the loan is fully paid) and they will release the vehicle’s original documents, which they typically hold as collateral.

- Final Handover: Only after the loan is paid off and you have the lender’s clearance letter in hand do you sign the final Deed of Sale and hand over the original documents and the car keys to the new owner.

For more on safety with private buyers, read our guide on Avoiding Scams When Selling a Car.

The Simpler Path: Selling to a Dealership

Selling a financed car to a reputable dealership like Autokunbo.com is by far the simpler and safer option. Dealerships are experienced in handling these transactions and can manage the entire process for you.

The process is streamlined:

- You provide the dealer with your loan details.

- The dealer contacts your lender to get the official settlement figure.

- You agree on a purchase price for the vehicle.

- The dealer pays the settlement figure directly to your lender.

- The dealer pays the remaining equity directly to you.

- You sign the car over to the dealership, and they handle all the complex paperwork with the bank to secure the original documents.

This process eliminates the security risks of dealing with private buyers and the hassle of coordinating a three-party transaction at a bank.

Comparing Your Options: Private Sale vs. Dealer Sale for a Financed Car

| Factor | Selling to a Private Buyer | Selling to a Reputable Dealer |

| Process Complexity | High. You are responsible for coordinating a three-way transaction between yourself, the buyer, and your bank. | Low. The dealer handles all communication and financial settlement with your lender on your behalf. |

| Transaction Speed | Slow. Can take time to find a buyer willing to go through the process and then coordinate a meeting at the bank. | Fast. The entire transaction, including loan settlement, can often be completed in 1-2 business days. |

| Security & Fraud Risk | High. You must manage the risk of payment fraud from a private individual. | Very Low. You are dealing with a registered business providing a secure, verifiable payment. |

| Required Seller Effort | Very High. Requires excellent communication, organization, and a deep understanding of the process to ensure it’s done safely. | Very Low. You simply need to provide your loan details and sign the final paperwork. The dealer does the rest. |

| Financial Outcome | You may achieve a higher selling price, but the complexity and risks are substantial. | You will receive a lower (wholesale) price, but the transaction is guaranteed, fast, and completely hassle-free. |

Key Takeaways

- Know Your Numbers First. Before you do anything, you must get two key figures: the official “Loan Settlement Figure” from your lender and your car’s current market value. These numbers will determine if you have cash coming to you or if you need to pay in to sell.

- Meet Private Buyers at the Bank—No Exceptions. The only secure way to sell a financed car to a private individual is to conduct the final transaction inside your lender’s banking hall. This ensures the buyer pays the bank directly, the loan is cleared, and the original documents are released safely for everyone involved.

- Understand Your Equity Position. If your car is worth more than the loan settlement amount, you have “positive equity,” and you will get cash back. If it’s worth less, you have “negative equity” and must be ready to pay the difference out of your own pocket to close the loan.

- Be 100% Transparent About the Loan. You must tell any potential buyer from the very beginning that the vehicle has an outstanding loan. Honesty is crucial for building trust and ensuring the buyer is prepared to follow the secure transaction process required.

- Consider a Dealership for a Simpler Sale. Selling to a reputable dealership is the easiest and safest path. They handle all the complex communication and paperwork with your lender, pay them off directly, and then pay you any remaining equity, removing all the hassle and security risks of a private sale.

Conclusion: Selling Your Financed Car with Confidence

Selling a car with an outstanding loan is entirely possible in Nigeria, but it is not a standard transaction. It requires absolute transparency with the buyer and a strict, secure process to ensure the lender is paid off correctly and the legal ownership is properly transferred. While a private sale may yield a higher price, the complexity and security risks are significant.

For most sellers in this situation, the speed, safety, and simplicity of selling to a trusted dealership that can manage the entire loan settlement process is the most prudent path.

Navigating a car sale with an outstanding loan can be complex. Let Autokunbo.com handle the hassle.

We provide fair valuations and can manage the entire settlement process with your lender, ensuring a secure, transparent, and fast transaction. Get your valuation today.