For most Nigerians, the aspiration to own a car is a major life goal. It represents freedom, convenience, and often, a vital tool for economic empowerment. Yet, in today’s economy, purchasing a vehicle outright with cash can feel like a monumental task.

This is where car financing comes in, transforming a distant dream into an achievable reality. The journey to securing a car loan in Nigeria, however, can seem like a maze of paperwork, confusing terms, and uncertain eligibility.

This is your ultimate, no-nonsense guide to demystifying the entire process. We will walk you through every step of financing a Tokunbo car, from understanding your options and preparing your documents to decoding interest rates and making the smartest financial choice for your future.

With this expert guidance, you can navigate the financing landscape with confidence and get behind the wheel of your dream car sooner than you think.

Key Takeaways

Before you dive into the details of securing a car loan, here are the five most important takeaways every prospective car buyer in Nigeria needs to know:

- Preparation is Power: Your journey begins long before you talk to a lender. A realistic budget that includes the Total Cost of Ownership (not just the car’s price) and an understanding of your own creditworthiness are your most powerful tools.

- Compare All Lender Types: Never accept the first loan offer you receive. Methodically compare interest rates, tenures, and fees from different types of lenders—traditional banks, specialized auto financiers, and modern fintech platforms—to find the best deal.

- Documentation is Crucial: Incomplete or incorrect paperwork is the number one reason for loan application delays and rejections. Meticulously gather all required documents, especially for business owners, before you begin the application process.

- Understand the Total Cost of Credit: A low monthly payment can be misleading. Always focus on the total cost of the loan, which includes interest and all fees over the full term. Use a loan calculator to understand this before you commit.

- Financing is Widely Accessible: Contrary to old beliefs, financing for high-quality Tokunbo cars is now readily available in Nigeria. With the right preparation and a credible partner, securing a loan for your vehicle is an achievable goal for both salaried individuals and business owners.

Bank Loans, Dealer Financing, or Online Lenders: Choosing Your Path

The Nigerian financial market now offers several avenues for financing a Tokunbo car, each with unique characteristics. Understanding the landscape is the first step to choosing the right partner for your journey.

Traditional Bank Loans: The Established Route

Commercial banks remain a primary source for auto loans. They often offer competitive rates, especially if you have an established relationship and a salary account with them. However, their processes can be more document-intensive, and many of their prime auto loan products are heavily marketed for brand-new vehicles. This means that while they do finance Tokunbo cars, the terms might be different or fall under a general-purpose loan category.

Based on our extensive market research, here is a comparative overview of what some major Nigerian banks offer:

| Bank Name | Indicative Interest Rate Range (p.a.) | Maximum Loan Tenure | Minimum Equity (Deposit) | Key Features & Notes |

| Access Bank | Competitive; Special rates for women | Up to 48 months | As low as 10% | Explicitly finances pre-owned vehicles; can cover maintenance & registration costs. |

| Polaris Bank | 25% (on partner deals for new cars) | Up to 48 months | As low as 10% | Tokunbo cars eligibility for special deals needs direct confirmation; general auto loan may apply. |

| Zenith Bank | 18% (marketed for new cars) | Up to 60 months | Minimum 10% | Terms for Tokunbo cars need direct verification. Often partners with dealers for promotions. |

| First Bank | Competitive | Up to 48 months | 30% | Primarily advertised for new vehicles from approved vendors; requires salary account domiciliation. |

| Sterling Bank | 36% – 40% (via Specta Loans) | Up to 48 months | Not specified | Not a dedicated auto loan but can be used for car purchase; higher interest rates reflect this. |

Note: Terms are indicative and subject to change. It is essential to confirm the specific terms for Tokunbo car financing directly with each bank.

For a detailed review of bank-specific offers, read our guide: Comparing Car Loans from Nigerian Banks.

Fintech and Online Lenders: The Digital Disruption

A growing number of financial technology (fintech) companies are transforming the car loan landscape with speed, convenience, and a digital-first approach. They often target the specific needs of Tokunbo car buyers.

- Autochek Africa: A leading platform that partners with banks like Access Bank to offer a streamlined, paperless loan process for pre-inspected vehicles. Their “Drive Now, Pay Later” model simplifies the journey from application to delivery.

- AltDrive: Operating under a non-interest banking model (Sharia-compliant), AltDrive finances used cars up to 15 years old, making it an excellent option for the Tokunbo market. They typically require a 15% deposit.

- Moove: While more focused on “mobility entrepreneurs” (e.g., ride-hailing drivers), Moove provides a unique vehicle ownership solution that is highly relevant for those looking to use their car for business.

For a deeper look into the online application process, see our guide: Getting a Car Loan Online.

Dealership Financing: Convenience at a Cost?

Many car dealerships offer in-house financing or facilitate loans through partner institutions. The primary advantage is convenience—you handle the car purchase and loan application in one place. However, it’s crucial to be cautious. Interest rates can sometimes be higher, as the dealer may add a margin to the loan. Always compare a dealership’s offer with one you’ve secured independently from a bank or online lender.

The Documents Needed for Your Car Loan Application

This is where preparation pays off. Having your documents in order before you apply is the single best way to ensure a smooth and fast process. The requirements differ slightly for salaried individuals and business owners.

For Salaried Employees:

- Completed Loan Application Form from the lender.

- Proforma Invoice from the car dealer (in this case, Autokunbo.com).

- Valid Government-Issued ID (National ID Card, Passport, Driver’s License).

- Recent Payslips (typically for the last 3-6 months).

- 6 Months of Bank Statements from your salary account.

- Letter of Employment confirming your status.

- Recent Utility Bill as proof of address.

- Your Bank Verification Number (BVN).

For Business Owners/Self-Employed Individuals:

You will need all the personal documents above, plus your business documentation:

- Certificate of Business Registration (CAC documents).

- 12 Months of Business Bank Statements.

- Often, Audited Financial Statements and your Tax Identification Number (TIN).

- A Board Resolution to Borrow if you are a limited liability company.

For a downloadable checklist, see our full guide: Loan Application Documents.

From Application to Approval: The Car Loan Process Explained

Understanding the timeline helps manage expectations. Here’s a step-by-step breakdown:

- Getting Pre-Approved (The Power Move): Before you even start serious car shopping, approach your bank or an online lender for a loan pre-approval. This tells you exactly how much you can afford to borrow, giving you immense negotiating power with sellers.

- Submitting Your Application: Once you’ve chosen a car and have your proforma invoice, you submit your application along with all the required documents.

- The Underwriting Process: This is the lender’s risk assessment phase. They will perform credit checks, verify your income, and assess your debt-to-income ratio. This can take anywhere from a few hours for a fintech lender to several days for a traditional bank.

- Approval and Disbursement: If approved, you will receive a loan offer letter detailing the terms. Once you accept and pay your equity contribution (down payment), the lender will disburse the funds directly to the seller (e.g., Autokunbo.com). With modern platforms, the entire process from final application to car delivery can take as little as 5 business days.

Special Financing: Options for Every Situation

What if your financial situation isn’t straightforward, or you’re not buying a standard sedan? There are still paths to ownership.

“Buy Here Pay Here Abuja”: What About Bad Credit?

Securing a loan with a poor credit history is challenging but not impossible. While true “no credit check” offers are rare and often come with predatory interest rates, some lenders will consider your application if you can provide a significant down payment (30% or more), show a stable income, and opt for a shorter loan tenure.

Financing for Commercial Vehicles

Need a loan for a Siena for your transport business, a Hilux for your construction site, or a Hiace bus? The requirements are often more stringent than for a personal car loan, usually requiring business registration documents (CAC), a strong business account statement, and a clear business plan.

Understanding PCP vs. Hire Purchase

- Hire Purchase (HP): This is the most common model for installment payments in Nigeria. You pay a deposit and fixed monthly installments. The car is legally owned by the finance company until you make the final payment.

- Personal Contract Purchase (PCP): More common for new cars, PCP involves lower monthly payments because you are only covering the car’s depreciation. At the end of the term, you have a choice: make a large “balloon payment” to own the car, return it, or trade it in. This is less common for Tokunbo cars in Nigeria.

For a full explanation, read our guides on Securing Car Finance with Bad Credit, Business Vehicle Loans Nigeria, and PCP vs. Hire Purchase Explained.

Decoding Car Loan Interest Rates and the True Cost

A low monthly payment can be misleading. It’s the total cost of credit that truly matters.

APR and Interest Rate

The Annual Percentage Rate (APR) is the most important number. It represents the yearly cost of your loan, including the interest rate and most fees. In Nigeria, car loan interest rates from traditional banks typically range from 18% to 25% per annum. Fintech lenders or loans for those with weaker credit can be higher.

The Power of an Amortization Table

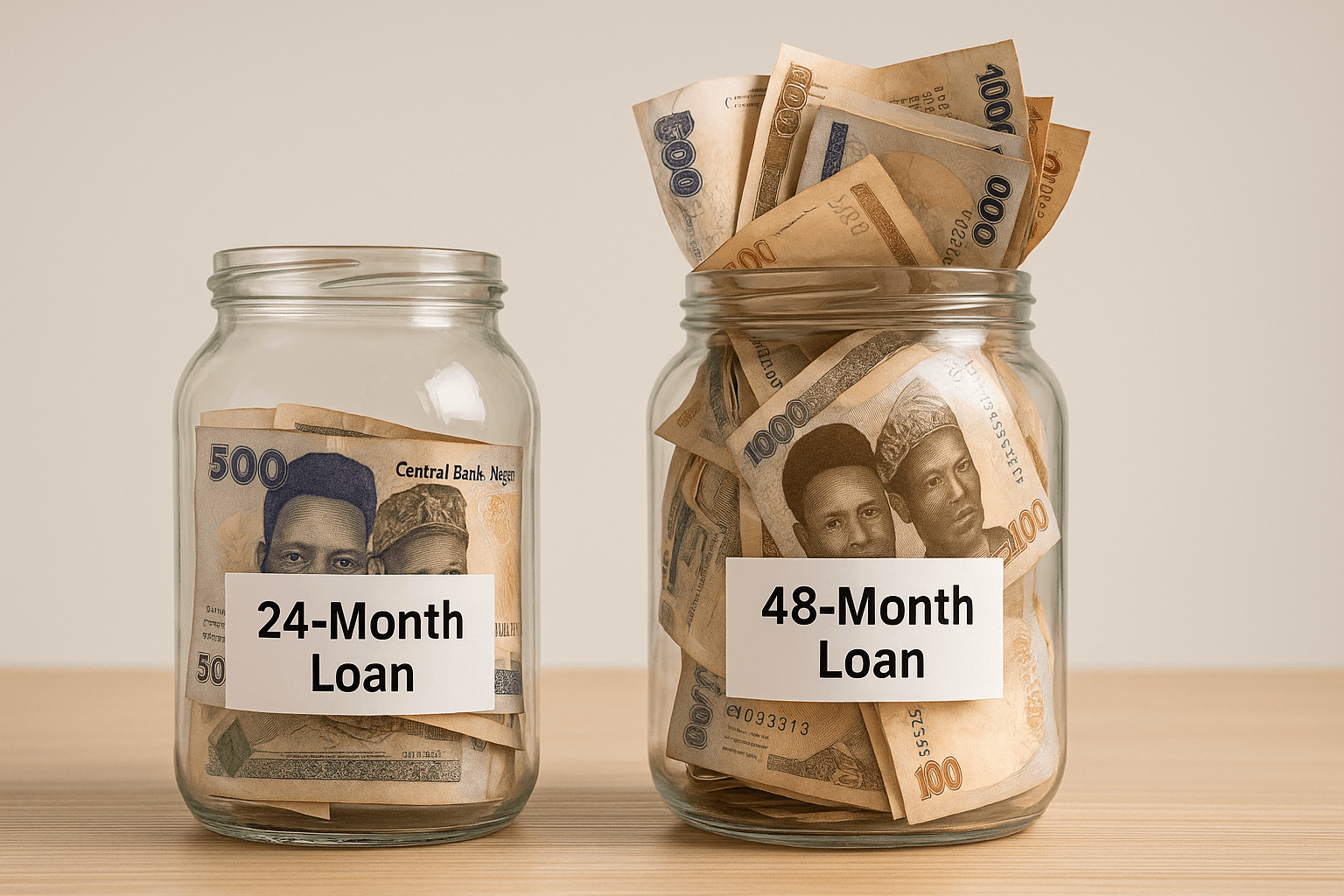

An amortization table shows you exactly how each payment is broken down into principal and interest. Let’s look at a simplified example for a ₦5,000,000 loan at 20% p.a.

| Loan Term | Estimated Monthly Payment | Total Interest Paid | Total Amount Paid |

| 24 Months (2 years) | ~₦254,482 | ~₦1,107,568 | ~₦6,107,568 |

| 48 Months (4 years) | ~₦151,960 | ~₦2,294,080 | ~₦7,294,080 |

As you can see, doubling the loan term from 2 to 4 years almost doubles the total interest you pay. A shorter term, if you can afford the monthly payments, saves you a significant amount of money in the long run. For a deeper understanding, explore our guide: Understanding Loan Terms & Interest Rates.

Conclusion: Financing Your Dream Car the Smart Way

Securing a car loan in Nigeria is a clear and achievable process when you are equipped with the right knowledge. The key is to be proactive and strategic. Start by getting pre-approved to understand your budget, meticulously gather your documents, and always compare offers from multiple sources. Most importantly, focus on the total cost of the loan, not just the monthly payment.

Ready to take the next step? At Autokunbo.com, we simplify the financing process. We partner with leading financial institutions to bring you competitive rates and transparent terms on fully inspected Tokunbo vehicles. Get pre-qualified in minutes and see what you’re eligible for today. Your dream car is closer than you think.